[Love Investor] Why You Have to Invest

Disclaimers:

This blog is about a radically intuitive way to invest in the stock market and generate wealth. If you invest with these principles, the odds are you will become a very successful “love-term” investor. However, the stock market is inherently risky, especially in the short-term. Use your own judgement and common sense.

If you indeed become a Love Investor, you will be disbelieved and ridiculed by many people and “money experts” who either are in the dark, or have interests in keeping you from investing your own money. If you just want to be liked or understood, let them manage your money or invest in an index fund. But if you want to generate long-term wealth with your own love, read on.

When I was a 13-year-old boy, I was fed up with schools. I hated literature, loathed math (I know it’s hard to believe), and despised history. I liked physics only because my teacher was both funny and good looking. So one day, I asked my father, “why do I need to go to school?”

“So you can gain knowledge,” he gave the most standard and boring answer.

“What’s knowledge good for?” I followed.

“So you can get a good job,” he tried to conclude.

“Why do I need a good job?” I kept up.

“So you can make lots of money,” he again tried to conclude.

“Why do I need that much money?” I kept asking.

I believe this was when he realized he was entangled with his son in a conversation where one party kept asking why, which will inevitably descend into a one-sided philosophical discourse that would drive him mad.

Instead of being frustrated or shutting down, he took a breath, looked me straight in the eyes, and gave me an answer that was the mother of all answers:

“You make a lot of money, so an awesome woman will be willing to marry you someday. And when she asks whether she can buy something expensive, instead of you arguing with her on why she shouldn’t waste the money, you chide her for even bothering you with this question and wasting your time. ‘Just buy it!’ That’s what you tell her. That way you’d never need a divorce.” He answered.

“Got it!” I remember the confused 13-year-old answered.

I needed to have money, so I don’t get a divorce someday. I can poke a thousand holes into his answer, which was either a flooding technique aimed to overwhelm me from keeping asking more WHYs or his way of keeping-it-real. I don’t even know how much that reasoning influenced me over the years. But all I know is that money hasn’t been an issue for me because of my investment. Today I am blissfully married with two kids, and my wife and I have never discussed divorce. Now you can see why my father has been my best male friend, and I still go to him for all kinds of sage advice today.

Wise fathers know how to answer tough questions

When it comes to money, our society cannot make up its collective mind. For a while in our country, people worshiped Bill Gates, Warren Buffett, and Elon Musk, and ate up everything they say as the truth, just because they are rich and successful. In other periods, it was cool to hate money or the idea of being rich. It was as if the process of making money would inevitably turn you into a greedy bastard.

I am not here to make any moral argument about money, but I can indeed tell you, having money, in many ways, helps a lot in your life. It determines whether or when you can buy a house, when you get to retire comfortably, if you can start your own business without going hungry, if you can raise a family without stress, and if you can help your future kids with their tuitions so they won’t be locked in debt, like many in our generation are. Oh, money indeed helps with preventing divorce.

So how do you have money? Well, it depends on three factors:

How much money you will make

How much money you will save/invest

How much return your saving and investment will generate

There are many blogs, books, and podcasts that talk about making and saving money. The currently popular FIRE (Financial Independence, Retire Early) Movement has taught and inspired many millennials and Gen Zs to increase income streams, radically cut spending, and save for early retirement. They are great tools, but are not my expertise the emphasis of this place. Here at Love Investor, I will mainly focus on #3, generating returns on your investment. In fact, I will demonstrate to you that the choices you make on saving/investing your money will have as much impact, if not more, on your financial wellbeing and retirement plans over the long-term.

What to do with your savings has huge long-term ramifications

Say there are three people, Amy, Brian and Chris, all at age 30. After some initial struggles with career search and managing and paying off debt, they finally have decent jobs and some money to spare. The days of living paycheck-to-paycheck is gone. It’s time to think about saving for the future.

Determined and disciplined, they have decided to save $1,000 per month. Where do you put the money? Where would you be at age 65? (By the way, I am not saying that’s when they decide to retire. They might want to retire early or later. But for the sake of argument, let’s use 65 as a discussion point).

Amy is a conservative saver who believes that you shouldn’t risk any money in the up-and-down markets. So she does something safe: opening up a high-yield savings account. As of Feb 2020, their interests are at 0.4%. We are in a historically low-interest environment. For the sake of argument, let’s bump it up to an annualized return of 2%. If she consistently saves $1,000 and put it in this account, where would she be at age 65?

Brian, on the other hand, wants to invest using stocks. He understands the power of compound interests and the need to invest in the long term, but he doesn’t believe in picking individual stocks. Over the past 80 years, the stock market has returned about 10% per year. Brian puts his $1,000 per month into an S&P 500 Index fund. No, past performance doesn’t indicate future ones, but for the sake of argument, say Brian’s investment will grow 10% into the future through its ups and downs. Where will it be on Brian’s 65th birthday?

Let’s enter Chris, who, through some amazing investment strategy, actually out-performances the market. According to Warren Buffett, a benchmark for a great return is 15% per year. For the sake of argument, let’s use that return for calculation purposes: 15% annual return for his 1,000/month saving. Where would that put Chris at age 65?

The answer for these three people are:

Amy the Saver (2%): $607,548

Brian the Index Investor (10%): $3,796,638

Chris the Great Investor (15%): $14,677,180

How you invest your savings can mean being poor and being very rich over the long term

Many people understand the power of compound interests (Albert Einstein calls it the 8th wonder of the universe), so you might not be that surprised by the difference in returns between Amy the saver (at 2%) and Brian the index investor (at 10%). That 8% difference in annualized returns will result in a $3,189,090 difference in total number over 35 years, going from retiring poorly to retiring comfortably.

However, people are generally shocked by the results of Brian, the index investor (10%), and Chris the great investor (15%). That 5% difference in annual returns will result in an astounding $10,880,539, which is the difference between being comfortable to being rich.

Let’s take one step further. If the fourth person, Diane, through some voodoo magic, is able to achieve a 20% annual return, she would retire at 65 with $62,049,317. That number, using a Silicon Valley term that describes tech entrepreneurs getting rich, is called “F U money.” (It comes from the fantasy that when you quit your job, your terrible boss tells you “you can’t quit”, you tell him off while showing him your bank account.)

Even with the understanding of compound interest, most people can’t comprehend how a small increase in the annual return on the upper range can have a jarring impact over the long-term. That percentage of outperforming the market, whether it’s 2%, 5%, or 10%, is called alpha. That alpha can determine the fate of your retirement and long-term wealth.

“That all sounds fantastic,” you might say, “but where can I generate a guaranteed long-term return of 15%? Just tell me where to deposit the money (along with which lottery number to buy). Thank you very much!” Well, it won’t be that easy, and there is certainly no guarantee. Investing in anything other than the US Treasuries bonds (generally considered the safest investment) will inherently incur risks. But I am here to teach you a fun, active-passive (I’ll explain this later) investment strategy called Love Investing to help you outperform the stock market and achieve alpha.

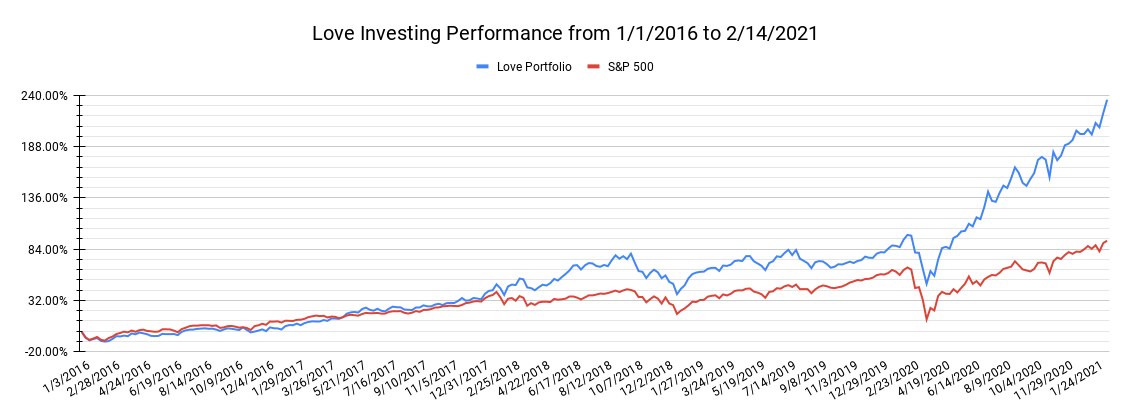

My actual Love Portfolio since 2016 compared to the S&P 500. I’ll teach you to build yours.

To learn this strategy, here are what you don’t need:

1. Complicated maths and financial knowledge: I’ll reveal a secret to you: I’m only OK with math. I know I probably dishonored my ancestors by admitting this, but don’t let the stereotype trip you up. I didn’t achieve this return based on complex statistical and financial understanding. If you know some basic arithmetic, like division and fraction, you can do it.

2. Existing savings: This is not like investing in startups which requires a decent amount to get you in the door. Love Investing is all about investing in stocks of publicly traded companies. You should start today, whether you are 25, 30 or 40. You can invest any amount, starting with your next batch of saving, whether it’s $500 or $5,000.

Here are what you do need:

1. What you already know. “Follow your heart” is one of the cheesiest movie lines you can get, but it is the foundation of Love Investing. You already know which companies to invest in. I am here to introduce you the methodology to pull it out of you and build a portfolio you will love.

2. Willingness to be different. When you mention what you are doing to your family, friends, or ‘experts’ in the future, many people will scream the conventional wisdom at you: “Stock investing is too risky; You can’t beat the market. You need to invest in an index fund.” Ignore them if you don’t like them anyway. But if you like them, show them your return chart and point them to this website. They will thank you later.

3. Patience: again, there is no guarantee in investing. Stocks go up and down daily. You might see short-term pops and dips. But over the long-term, the market (S&P 500) has generated 10% return over the decades. To generating alpha returns, you will also need to invest in the long-term. If you can’t stomach a March 2020 COVID style market correction, you shouldn’t do this. Because it will happen again and again. But it’s your patience that will help you capture the opportunity that follows a dip like that.

OK, let’s do this. The goal for my blog is to help you generate market-beating returns over the long-run, so you can have the financial freedom that will make you and your spouse (or future spouse) stay married. Someday when your kids ask you, “why am I born”? You mention me as the reason. That’s all I ask.

If you read the articles above and TRULY love the premise and writing, and want to invest using this method, I am inviting you to become one of Love Investor’s 1,000 True Fans. I want to learn more about you, and write with you in mind. I will also personally answer your emails. The invitation will close once 1,000 is reached. If you don't love my writing, please do not fill the info. I want to save the space for true lovers.